Risk management

Basic policy

The Group’s basic policy for risk management is as follows:

- When setting strategies and business performance targets and engaging in efforts to achieve them, we seek integration of strategies and risk management by considering risk profiles, risk appetite, risk capacity and risk tolerance.

- By recognizing risks clearly at an earlier stage and promptly providing as many choices as possible for risk management, we reduce the possibility of unachieved business targets, losses, accidents, and failures.

- By monitoring risks on a regular basis, we address any deviation from intended performance swiftly and with consistency.

- With a grasp of our comprehensive and consistent risk portfolio, we seek optimum allocation of the Group’s resources.

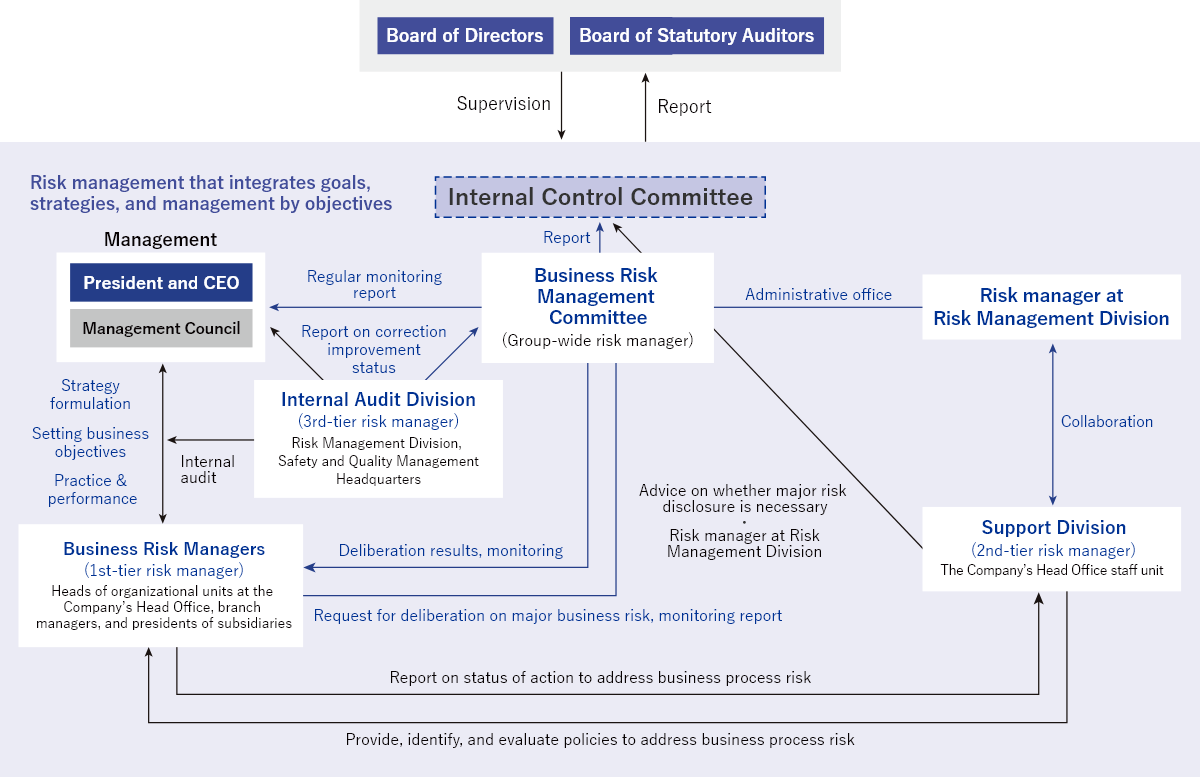

Risk management system

We have formulated the Risk Management Rules that specify the basic points involved in risk management and have established risk categories in addition to the Risk Management Division that handles them. We have also established the Business Risk Management Committee as the Group-wide risk manager, as we build and operate systems to identify and evaluate risks on a Group-wide level.

Risk management category

| Risk management category | Description of the risk | ||

|---|---|---|---|

| Business risk | Management risk | Business environment risk | Risk relating to changes in the management and business environments |

| Management strategy risk | Risk relating to the decision-making concerning management and business strategies, etc. | ||

| Business process risk | Risk relating to daily business operations | ||

| Disaster risk | Risk relating to the occurrence of natural disasters | ||

Risk management system

Business Risk Management Committee

As the Group-wide risk manager, the committee was established to provide the risk management systems required to accomplish strategies and business performance targets in the process of creating, maintaining, and realizing value and to steadily provide the Group’s stakeholders with reasonable expectations that risks can be controlled to a tolerable amount. The standing members of the Committee are the General Manager of the Corporate Planning Division, the General Manager of the Group Business Promotion Division, the General Manager of the Accounts & Finance Division, and the General Manager of the Risk Management Division.

The number of meetings held in fiscal 2022 was 15.

Business Risk Manager (1st-tier risk manager)

As the 1st-tier risk managers, the Business Risk Managers set forth strategies that are consistent with the Exeo Group's mission, vision, and core values. In addition, the managers develop concrete action plans and manage the progress thereof to address risks according to the environments of their organizations and in line with the risk-addressing policies presented by the Support Division teams.

Support Division (2nd-tier risk manager)

As the 2nd-tier risk managers, the Support Division teams provide guidelines for addressing the category of risks they attend to and monitor the appropriateness and effectiveness of measures taken to address risks and the status of corrections.

Internal Audit Division (3rd-tier risk manager)

As the 3rd-tier risk manager, the Internal Audit Division conducts internal audits of the performance of the Business Risk Managers to identify problems and matters to be improved, issues recommendations for improvement, provides the latest information on the matters to be improved, and verifies the status of improvement.