Remuneration of officers

Basic policy

To decide the amounts of compensation for directors and the applicable calculation methods, we have a three-pronged basic policy of “effectively-functioning incentives to drive medium- to long-term growth in business value,” “setting levels that enable us to secure and retain outstanding talent,” and “decision-making processes that are transparent and fair.” Our policy concerning decision-making is deliberated by the Compensation Committee, which is comprised of directors including independent outside directors appointed by the Board of Directors (chaired by an independent outside director), and then determined by resolution of the Board of Directors.

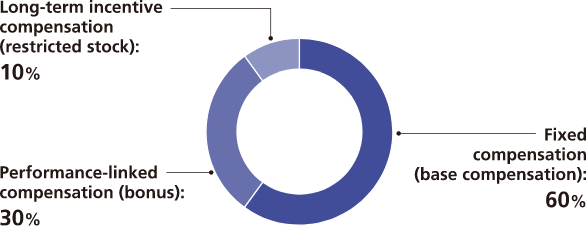

Compensation for directors (excluding outside directors) consists of base compensation, bonuses, and restricted stock, the ratios for which are as indicated below (ratios include employee salaries and bonuses in the case of directors who also serve as employees).

Composition of director compensation (exsluding outside directors)

Composition of director compensation

| Classification of officers | Total amount of remuneration, etc. (¥Million) | Total amount of remuneration, etc. by type (¥Million) | Number of eligible officers | |||

|---|---|---|---|---|---|---|

| Monetary remuneration | Long-term incentive compensation | |||||

| Base compensation | Bonus | Restricted stock | ||||

| Director (excluding outside directors) | 213 | 105 | 69 | 37 | 8 | |

| Statutory auditors (excluding outside statutory auditors) | 40 | 40 | ー | ー | 3 | |

| Outside officers | Outside directors | 57 | 57 | ー | ー | 5 |

| Outside statutory auditors | 28 | 28 | ー | ー | 4 | |

Note: 1. Amounts are rounded down to the nearest million yen.

2. The above figures include two directors and one auditor who retired at the conclusion of the 68th Ordinary General Meeting of Shareholders held on June 24, 2022.

3. Since outside directors and statutory auditors are independent from the execution of business, their remuneration is limited to base compensation.

Fixed compensation (base compensation)

Base compensation is aligned with the rank of the position and is fixed at an appropriate level based on consideration of the business environment and market rates.

Performance-linked compensation (bonus)

Bonuses are paid to directors (excluding outside directors) as performance-linked compensation. Amounts paid are determined based on a comprehensive consideration of the business environment and other factors, with the basic principle of linking bonuses to business performance during the fiscal year under review.

Metrics used for calculating bonuses are consolidated net sales, consolidated operating profit, and profit attributable to owners of parent. The reasoning behind the use of these metrics is that directors have responsibility as managers for the overall consolidated performance. For calculation, we multiply base compensation by an index that accounts for achievement level of the business plan and a qualitative evaluation.

Performance-linked compensation calculation metrics, targets, and results

| Metric | Target | FY2023 actual |

|---|---|---|

| Consolidated net sales | ¥630.0 billion | ¥614.0 billion |

| Consolidated operating profit | ¥34.0 billion | ¥34.1 billion |

| Profit attributable to owners of parent | ¥23.6 billion | ¥20.0 billion |

Long-term incentive compensation (restricted stock)

As long-term incentive compensation,11,800 shares of restricted stock have been issued to six directors (excluding outside directors). Restricted stock consists of performance-linked restricted stock and continuous service-linked restricted stock.

Components of long-term incentive compensation

| Type | Performancelinked metrics | Overview and rationale for selection as metrics |

|---|---|---|

| Performancelinked restricted stock | Consolidated operating profit | This stock is granted in accordance with the rank of the employee, based on linkage with the achievement of business results through medium- to long-term consolidated profits, for the purpose of providing medium- to long-term incentives for continued increases in our business value and promoting the sharing of value with shareholders. We use consolidated operating profit as the performance-linked metric since it is directly linked to the achievement of performance targets and sharing of value with shareholders. |

| Continuous service-linked restricted stock | ー | The condition for waiving the restriction on transfer is that the employee continuously serves as one of our directors or in a certain other position for a certain period of time. |

Compensation for outside directors and statutory auditors

Since outside directors and statutory auditors are independent from the execution of business, their remuneration is limited to base compensation.

Delegated determinations

The President and CEO determines the specific amount of compensation for each individual director in the Group based on authority delegated by resolution of the Board of Directors.

Such authority, which governs the determination of the amount of base compensation and bonuses for each director, was delegated to the President and Representative Director on the grounds that the President and Representative Director is the most suitable person to evaluate, in the context of the Company’s overall performance, each of the businesses for which directors are responsible.

The Board of Directors has made it a condition of the above delegation that the Compensation Committee shall confirm that details such as the amount of base compensation for each director are appropriate, to ensure that the above authority may be properly exercised by the President and Representative Director. Since the amount of remuneration for each individual director has been determined through such confirmation procedures, the Board of Directors has determined the content to be in line with the decision-making policy.

The Compensation Committee, which conducts the above procedures, met three times during the fiscal year under review.

Matters concerning resolutions of the General Meeting of Shareholders regarding remuneration, etc. of directors and statutory auditors

| Classification | Type of compensation | Maximum compensation amount | Resolutions at the General Meeting of Shareholders | Number of officers at time of resolution |

|---|---|---|---|---|

| Director | Monetary remuneration | Up to ¥350 million/year*1 | June 23, 2009 55th Ordinary General Meeting of Shareholders |

8 |

| Remuneration for performance-linked restricted stock | Up to ¥50 million/year, up to 50,000 shares/year*2 | June 21, 2019 65th Ordinary General Meeting of Shareholders |

12 (excluding outside directors) | |

| Remuneration for continuous service-linked restricted stock | Up to ¥50 million/year, up to 50,000 shares/year*2 | |||

| Statutory auditors | Monetary remuneration | Up to ¥80 million/year | June 23, 2009 55th Ordinary General Meeting of Shareholders |

5 |

*1 Not including employee salaries in the case of directors who also serve as employees

*2 Outside directors are not eligible