Engagement with the TCFD Recommendations

Basic approach

The Group considers environmental problems such as climate change to be important issues for management to address. Based on this awareness, we defined practicing ESG management as one of the challenges in our 2030 Vision announced in May 2021, and set environmental, social, and governance KPIs respectively as well as specific targets in Medium-Term Management Plan (2021-2025), which we are working systematically and continuously to achieve.

We will actively engage in eco-friendly business practices, which include reducing greenhouse gas emissions, while also working actively to contribute toward solutions for climate-related social issues through businesses such as renewable energy.

Additionally, in December 2021 we declared our support for the recommendations of the TCFD (Task Force on Climate-related Financial Disclosures) and also joined the TCFD Consortium. The Group is making information disclosures according to the TCFD Framework.

Addressing the TCFD recommendations

(Update June 2025) (446KB)

*Previous files are at the bottom of the page.

TCFD published its final report in June 2017 and recommended that companies disclose the following information pertaining to their governance, strategies (risks and opportunities, financial and other impacts, handling), and other initiatives.

| Governance | Strategy | Risk management | Metrics and goals |

|---|---|---|---|

| Monitoring systems and the role of the management team pertaining to climate-related risks and opportunities | Identifying climate-related risks and opportunities and their impacts on the organization’s businesses, strategy, and financial planning | The processes used by the organization to identify, assess, and manage climate-related risks | The metrics and goals used to assess and manage relevant climate-related risks and opportunities |

Governance

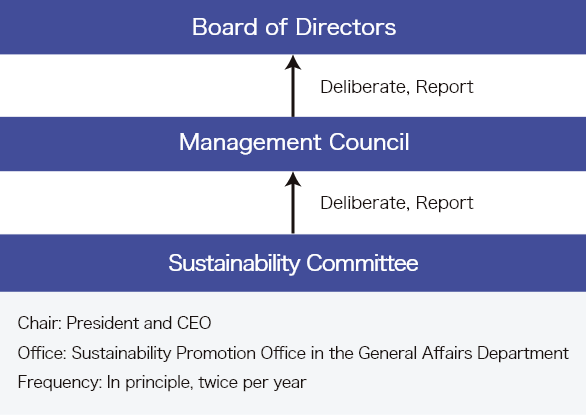

- The Group has established the Sustainability Committee chaired by the President and CEO and has established the Sustainability Promotion Office in the General Affairs Department as a dedicated organization for sustainability, primarily for taking measures against climate change. The aims of these actions are to help achieve a sustainable society, and to bolster efforts toward the continued growth of the Group.

- Established as an advisory body to the Management Council, the Sustainability Committee deliberates on matters such as our direction regarding sustainability, important issues, and goal setting, monitors the status of sustainability efforts, and deliberates and reports on these details in the Management Council and Board of Directors.

- The Sustainability Promotion Office in the General Affairs Department operates as the administrative office of the Sustainability Committee, while also playing the role of coordinating sustainability measures with Group companies, particularly measures against climate change, as well as setting goals for the Group as a whole and managing progress toward achieving them.

| Meeting Body | FY | Details |

|---|---|---|

| Board of Directors (Management Council) | 2022 |

|

| 2023 |

|

|

| Sustainability Committee | 2022 |

|

| 2023 |

|

Strategy

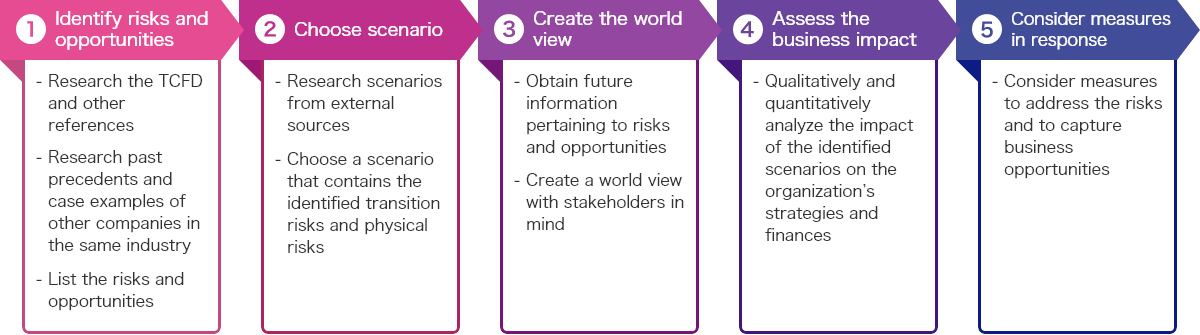

We use scenario analyses to anticipate what the world will be like in 2030 to ascertain the impact that climate change will have on our Group’s business. The primary information sources for our analyses were the 1.5℃ scenario by the International Energy Agency (IEA), and the 4℃ scenario by the Intergovernmental Panel on Climate Change (IPCC).

Scenario analysis steps

Scenario analysis results

1.5℃ scenario (scenario in which the necessary measures were taken to keep temperature rises to 1.5℃ compared to pre-industrial levels)

| Type | Climate change factor | Impact on the Group | Time line of impact*1 | Level of impact*2 | Key response measures | |

|---|---|---|---|---|---|---|

| 2030 | 2050 | |||||

| Risks | Introduction of carbon tax |

|

Medium / Long | ▼▼10 | - |

|

| Emissions controls |

|

Medium / Long | - | ▼2 |

|

|

| Shifting to renewable energy (renewable energy measures) |

|

Short / Medium / Long | ▼0.3 | ▼0.4 |

|

|

| Surging raw materials prices |

|

Short / Medium / Long | - | - | ||

| Obligation to disclose information |

|

Short / Medium / Long | ▼1 | ▼1 |

|

|

| Advancements in energy-saving and renewable energy |

|

Short / Medium / Long | ▼▼ | ▼▼ |

|

|

| Changing customer preferences |

|

Short / Medium / Long | - | - |

|

|

| Stakeholder assessments |

|

Short / Medium / Long | - | - | ||

| Opportunities | Renewable energy-related construction |

|

Short / Medium / Long | ▲▲ | ▲▲ |

|

| Market expansion |

|

Short / Medium / Long | ▲ | ▲ |

|

|

| Services for mitigating and addressing climate change |

|

Short / Medium / Long | ||||

| Adaptation to climate change |

|

Short / Medium / Long |

|

|||

| Stakeholder assessments |

|

Short / Medium / Long | - | - |

|

|

4℃ scenario (scenario in which measures to counter climate change are insufficient, and temperatures rise by approximately 4℃ compared to pre-industrial levels)

| Type | Climate change factor | Impact on the Group | Time line of impact*1 | Level of impact*2 | Key response measures | |

|---|---|---|---|---|---|---|

| 2030 | 2050 | |||||

| Risks | (Acute) Intensifying weather |

|

Medium / Long | ▼7 | ▼▼19 |

|

| (Chronic) Higher temperatures |

|

Medium / Long | ▼8 | ▼▼11 |

|

|

*1 Short time line: 3 years or less, Medium time line: Over 3 and up to 10 years, Long time line: Over 10 years

*2 Financial impact (profit) on business activities of the Group in fiscal 2030 is calculated under the assumption of certain conditions. Anticipating the relative magnitudes, risks are expressed as “▼▼▼ (large),” “▼▼ (medium),” and “▼ (small),” and opportunities as “▲▲▲ (large),” “▲▲ (medium),” and “▲ (small).” Impact scale in financial terms is (large): ¥10.0 billion or more, (medium): From ¥1.0 billion to less than ¥10.0 billion, and (small): Less than ¥1.0 billion

Risk management

We build and operate an organizational structure for risk management in the Group to be able to identify and evaluate risks on a Group-wide level. We have formulated the Risk Management Rules that specify the basic points involved in risk management and have established risk categories in addition to the Risk Management Division that handles them. We have also established the Business Risk Management Committee as the Group-wide risk manager.

We identify and evaluate risks related to climate change primarily in the Sustainability Committee. Information is also shared and coordinated in deliberations on individual matters in the Business Risk Management Committee, which includes verifying climate related risks.

Based on the Risk Management Rules, these are also integrated into Group-wide processes and matched against risks that have been assessed and identified in environmental management systems based on the ISO14001 international standard, and occupational health and safety management systems based on the ISO45001 international standard.

Metrics and goals

The Group has defined and is monitoring the following metrics and goals for managing climate-related risks and opportunities.

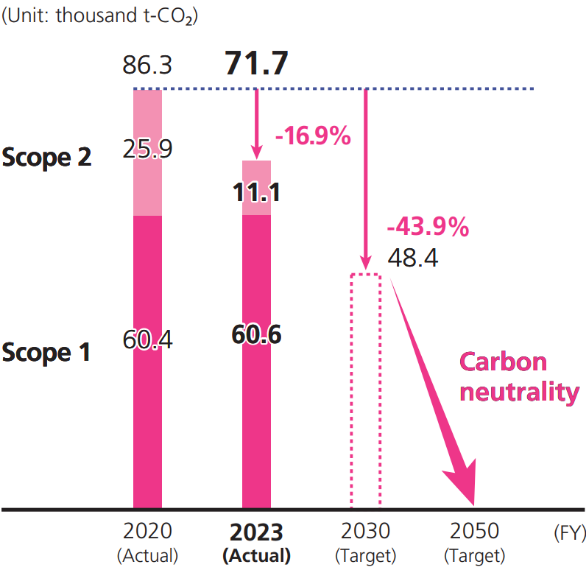

Targets

| Base year (FY2020) | Target year | Scope of data | ||

|---|---|---|---|---|

| FY2030 (vs. base year) | FY2050 | |||

| Scope1・2 | 86,583 | 50,218(-42%) | Carbon neutrality | Consolidated |

| Scope3 | 1,728,553 | 1,296,414(-25%) | - | Consolidated |

Submetrics

| FY2020 | FY2021 | FY2022 | FY2025 (Target) | Scope of data | |

|---|---|---|---|---|---|

| Switch to electricity from renewable energy sources | - | 33.6% | 73.2% | 100% | Company-managed sites of Exeo Group, Inc. |

| Adoption of EVs and other low-emission vehicles | 91.4% | 95.5% | 96.1% | 100% | Passenger vehicles of Exeo Group, Inc. |

Schematic of GHG emissions (Scope 1 & 2) reduction

GHG emissions by Scope (units: t-CO2, scope of data: consolidated)

| Base year (FY2020) | FY2022 | Difference | % change | |

|---|---|---|---|---|

| Scope 1 & 2 (our own) | 86,583 | 76,877 | -9,706 | -11.2% |

| Scope 1 (direct emissions) | 60,400 | 62,725 | 2,325 | 3.8% |

| Scope 2 (indirect emissions) | 26,183 | 14,152 | -12,031 | -45.9% |

| Scope 3 (supply chain) | 1,728,553 | 1,594,294 | -134,259 | -7.8% |

| Category 1 (purchased goods and services) | 275,913 | 195,614 | -80,299 | -29.1% |

| Category 2 (capital goods) | 41,490 | 51,742 | 10,252 | 24.7% |

| Category 3 (fuel- and energy-related activities) | 12,652 | 13,958 | 1,306 | 10.3% |

| Category 5 (waste generated in operations) | 2,429 | 5,279 | 2,850 | 117.3% |

| Category 6 (business travel) | 1,869 | 2,180 | 311 | 16.6% |

| Category 7 (commuting) | 3,398 | 3,965 | 567 | 16.7% |

| Category 11 (use of sold products) | 1,389,872 | 1,320,757 | -69,115 | -5.0% |

| Category 13 (downstream leased assets) | 930 | 799 | -131 | -14.1% |

* Greenhouse gas emitted by the Group is CO2 (carbon dioxide).

* Numerical values for the base year could be subject to change if applicable scope or calculation methods change as we make these calculations more sophisticated going forward, or if an event that exceeds the course of our business growth occurs.

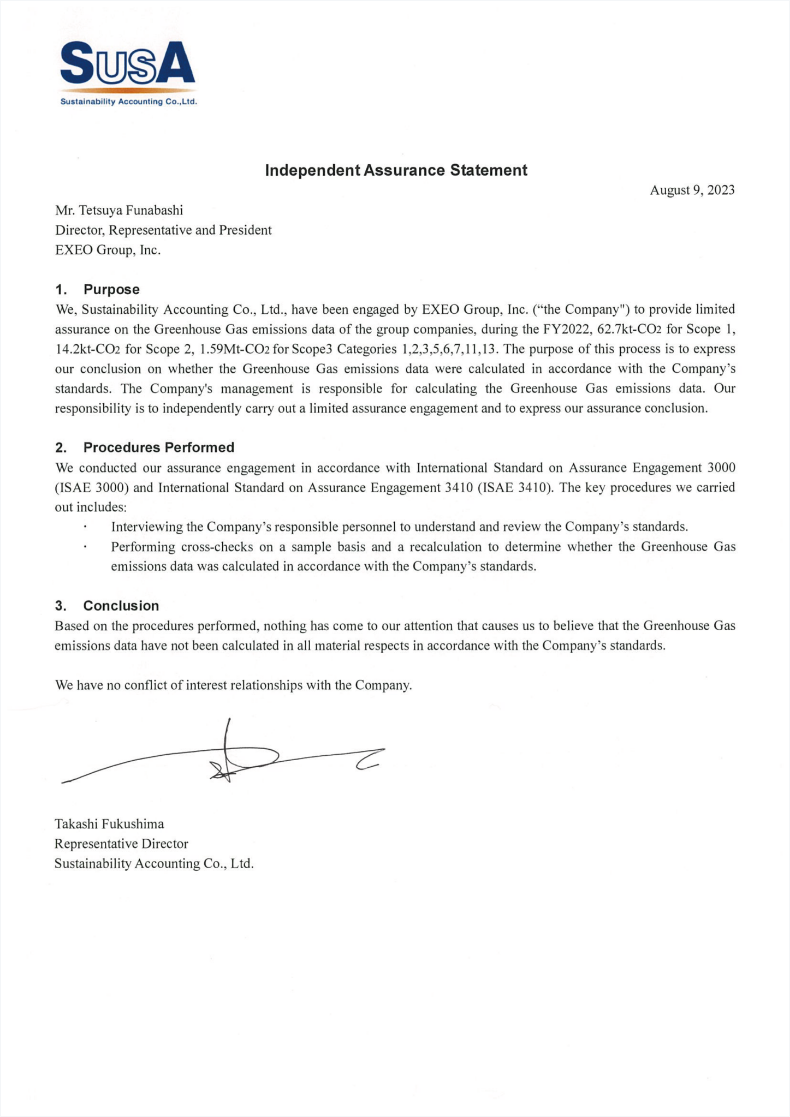

Assurance report from a third party

Archive

Addressing the TCFD recommendations (Update June 2024) (446KB)

Addressing the TCFD recommendations (Update Nov 2022) (783KB)