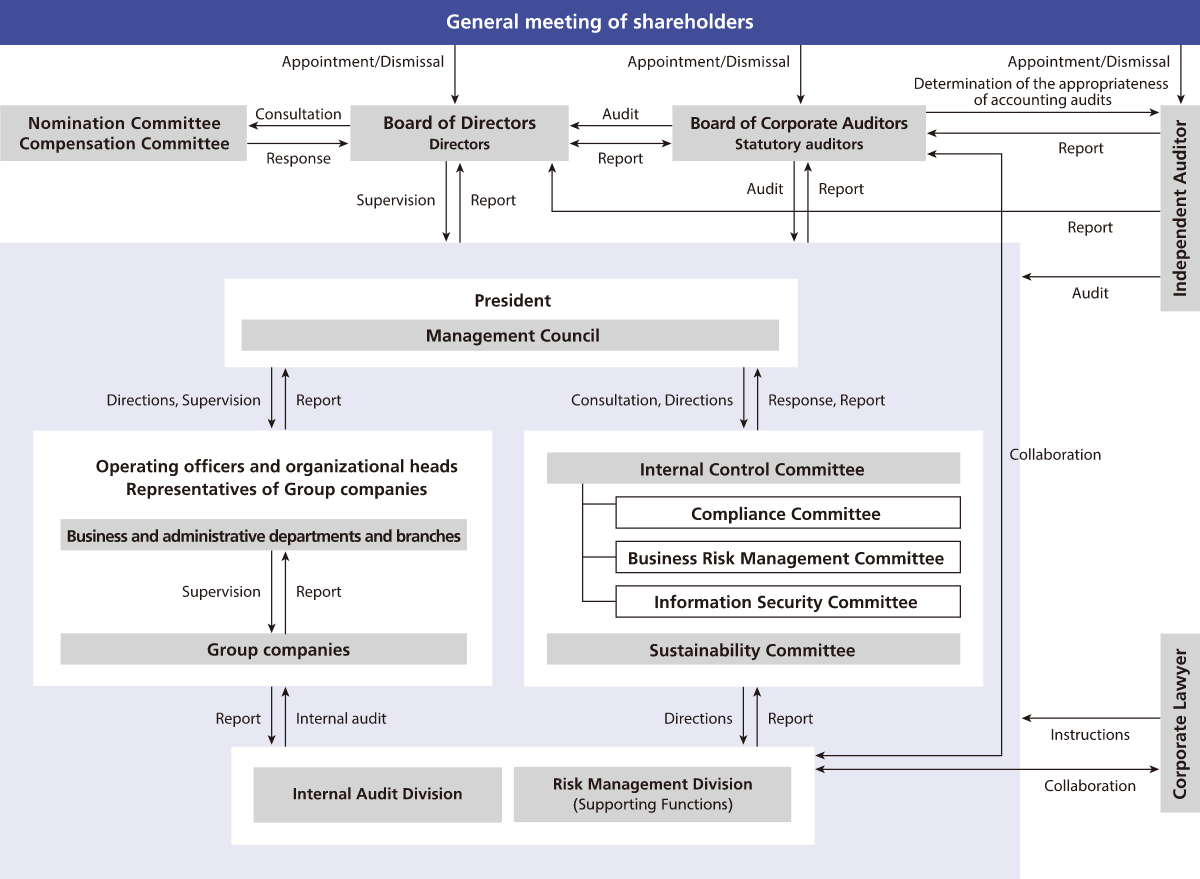

Corporate governance system

Governance system and rationale for adopting this system

The Company has adopted a Company with Audit and Supervisory Board format, having determined this system to be the most conducive to ensuring appropriate corporate governance. Members of the Board of Statutory Auditors attend meetings of the Board of Directors and other important meetings in accordance with the audit policy and audit plan. They observe, from a perspective of fairness and impartiality, the execution of duties by the Board of Directors and audit the business and financial conditions of major offices and Group companies.

We have also adopted an operating officers system to separate the management decision-making and supervisory function from the business execution function, to achieve prompt and appropriate decision-making and business execution while further strengthening our corporate governance. The Board of Directors, chaired by the President and CEO, makes decisions on important matters and supervises business execution. Operating officers execute operations based on the Board of Directors’ decisions. Furthermore, in our Management Council we discuss important matters pertaining to business execution.

Simplified chart of corporate governance system

| Format | Company with Audit and Supervisory Board |

|---|---|

| Directors | 12 (including 5 outside directors) |

| Auditors | 5 (including 3 outside auditors) |

| Number of Board of Directors meetings held in fiscal 2022 | 14 |

| Number of Board of Statutory Auditors meetings held this fiscal year | 14 |

| Operating officers system | Yes |

| Operating officers | 31 |

| Internal units of the Board of Directors | Nomination Committee and Compensation Committee |

Our corporate governance system (As of November 8, 2024)

Skills matrix of directors and statutory auditors

| Name | Corporate management & ESG | Innovation & DX | Engineering | Marketing & global business | Finance & accounts | Legal, human resources & labor relations | |

|---|---|---|---|---|---|---|---|

| Directors | Tetsuya Funabashi | ● | ● | ● | ● | ● | |

| Koichi Mino | ● | ● | ● | ● | |||

| Noriyuki Watabe | ● | ● | |||||

| Yuichi Koyoma | ● | ● | ● | ||||

| Takafumi Sakaguchi | ● | ● | ● | ● | ● | ||

| Fumitoshi Imaizumi | ● | ● | ● | ● | |||

| Shigeki Hayashi | ● | ● | ● | ||||

| Yasushi Kohara | ● | ● | |||||

| Naoko Iwasaki | ● | ● | ● | ||||

| Tatsushi Mochizuki | ● | ● | |||||

| Keiji Yoshida | ● | ● | ● | ● | |||

| Tomoko Aramaki | ● | ● | ● | ||||

| Statutory Auditors | Yasuo Otsubo | ● | ● | ● | ● | ||

| Shinji Kojima | ● | ● | ● | ||||

| Shinnosuke Yamada | ● | ||||||

| Kimiko Takahashi | ● | ● | ● | ||||

| Eiko Osawa | ● | ● |

Note: These are the skills that directors and statutory auditors are particularly expected to have, and this table does not comprehensively indicate their entire skillsets.

Officers’ activities in FY2022

★Independent officers ◎Chair or committee chair

| Name | Board of Directors | Nomination Committee | Compensation Committee | Board of Corporate Auditors | |

|---|---|---|---|---|---|

| Directors | Tetsuya Funabashi | ◎ 100% (14/14) | - | - | - |

| Koichi Mino | 100% (14/14) | ◎ 100% (2/2) | 100% (1/1) | - | |

| Noriyuki Watabe | 100% (10/10) | - | 100% (2/2) | - | |

| Yuichi Koyoma | 100% (14/14) | - | 100% (3/3) | - | |

| Kenji Asano | 100% (14/14) | 100% (3/3) | - | - | |

| Takafumi Sakaguchi | 100% (14/14) | 100% (2/2) | 100% (1/1) | - | |

| Fumitoshi Imaizumi | 100% (10/10) | - | 100% (2/2) | - | |

| Tomohiro Kurosawa | 100% (4/4) | 100% (1/1) | - | - | |

| Hideo Higuchi | 100% (4/4) | 100% (1/1) | - | - | |

| Yasushi Kohara ★ | 100% (14/14) | 100% (3/3) | ◎ 100% (3/3) | - | |

| Naoko Iwasaki ★ | 100% (14/14) | 100% (3/3) | 100% (3/3) | - | |

| Tatsushi Mochizuki ★ | 100% (14/14) | 100% (3/3) | 100% (3/3) | - | |

| Keiji Yoshida ★ | 100% (14/14) | 100% (3/3) | 100% (3/3) | - | |

| Statutory Auditors | Yuki Sakuyama | 100% (4/4) | - | - | 100% (5/5) |

| Yasuo Otsubo | 100% (10/10) | - | - | ◎ 100% (9/9) | |

| Masato Suwabe | 100% (14/14) | - | - | 100% (14/14) | |

| Tomoko Aramaki ★ | 100% (14/14) | - | - | 100% (14/14) | |

| Shinnosuke Yamada ★ | 100% (14/14) | - | - | 100% (14/14) | |

| Kimiko Takahashi ★ | 100% (14/14) | - | - | 100% (14/14) |

Note: Numbers in parentheses are times attended/number of meetings held during term as director. Discrepancies in number of meetings held are results of differences in time of appointment and/or leaving the position.

Transition to a stronger governance system

| Measure | Composition of the Board of Directors | Female directors | ||

|---|---|---|---|---|

| 2023 | Increased the number of outside directors (from 4 to 5) Outside officers now chair both the Nomination Committee and Compensation Committee |

7 inside 5 outside |

12 in total | 2 |

| 2021 | Increased proportion of outside directors |

7 inside 4 outside |

11 in total | 1 |

| 2020 | Increased the number of outside directors (from 3 to 4) The majority of the members of the Nomination Committee and Compensation Committee are outside members |

8 inside 4 outside |

12 in total | 1 |

| 2018 | Increased the number of outside directors (from 2 to 3) |

12 inside 3 outside |

15 in total | 1 |

| 2015 | Increased the number of outside directors (from 1 to 2) Using a third-party organization, conducted a questionnaire for evaluating the effectiveness of the Board of Directors |

9 inside 2 outside |

11 in total | 1 |

| 2014 | Appointed an outside director (1) |

11 inside 1 outside |

12 in total | 1 |

| 2009 | Adopted an operating officers system |

8 inside |

8 in total | 0 |

| 2003 | Established Nomination Committee and Compensation Committee |

18 inside |

18 in total | 0 |

![]() Outside director

Outside director

Nomination Committee and Compensation Committee

We have established a Nomination Committee and Compensation Committee comprised of directors including independent outside directors who were appointed in the Board of Directors, where we build common understanding on the evaluation criteria and compensation standards of each director and improve their supervisory function. Each committee is comprised of a majority of independent outside directors.

The Nomination Committee engages in activities with the objective of strengthening corporate governance by ensuring the objectivity, timeliness, and transparency of officer personnel-related matters. During fiscal 2023, they held discussions on the composition of the Board of Directors with the perspective of diversity in mind, and the director candidates selected as a result of these discussions were deliberated.

The Compensation Committee engages in activities with the objective of strengthening corporate governance by ensuring the objectivity and fairness of the compensation and other conditions of officers. The Compensation Committee for fiscal 2023 referred to research materials from outside institutions and other information to observe trends at other companies and investor perspectives and held discussions with the aim of adding new evaluation metrics for officer remuneration. They also proceeded with considerations for awarding stock-based compensation to Group companies and provided a report in a Board of Directors meeting.

Meetings in FY2023

| Nomination Committee | 3 meetings |

|---|---|

| Compensation Committee | 4 meetings |

-

Composition of the Nomination Committee for FY2024

Committee chairman Committee members

Mochizuki

Mino

Hayashi

Kohara

Iwasaki  Outside director

Outside director(honorifics omitted)

-

Composition of the Compensation Committee for FY2024

Committee chairman Committee members

Kohara

Watabe

Koyoma

Yoshida

Aramaki  Outside director

Outside director(honorifics omitted)

Audit system

Board of Statutory Auditors

In the Board of Statutory Auditors, we consider auditing policies and audit plans, the development and operational status of internal control systems, the appropriateness of accounting audits, and agreements on the evaluations and compensation of accounting auditors. In fiscal 2022, the Board of Statutory Auditors received detailed explanations from the Finance Department and accounting auditors, held lively discussions, and expressed opinions about changing the categorization of our reporting segments from corporate group to business domain, and about considerations for Key Audit Matters (KAM).

For statutory auditor audits, they conduct audits according to the auditing policy and audit plan in compliance with the statutory auditor audit standards determined by the Board of Statutory Auditors. Specifically, they attend important meetings such as the Board of Directors, audit the proceedings and resolutions, and express opinions when necessary. Aside from that, they conducted 71 interviews and field visits with the representative director, head office executives, main business locations, and subsidiaries (in fiscal 2022, the planned number of field visits was limited and shifted primarily to online meetings due to the COVID-19 pandemic), and audited business operations and financial conditions.

Standing statutory auditors report to the Board of Statutory Auditors on the results of their active communication and information sharing with related departments on important decision-related documents viewed, deliberations in the Management Council, and on the various issues. In everyday auditing activities, they gather information internally to comprehend the issues in our business groups and share information and opinions with outside statutory auditors in a timely manner. Outside statutory auditors express opinions from broad perspectives in the Board of Directors and Board of Statutory Auditors based on their extensive range of work experience and high-level expertise. Exchanging opinions also with the President and CEO, they receive explanations of management policies and leverage their expertise and experience to express their opinions from an outside perspective.

In fiscal 2022, outside directors and outside statutory auditors observed worksites, visited business locations, and exchanged opinions with general managers and younger executive-class personnel to gain a deeper understanding of the business being done. Three outside statutory auditors participated in these activities.

Accounting auditor

On the presumption of a high level of independence, advanced expertise, and appropriate systems for quality control, our Board of Statutory Auditors has determined that Grant Thornton Taiyo LLC is suitable to serve as our accounting auditor, having comprehensively considered their group auditing system established based on an understanding of the business fields in which we operate, their auditor compensation levels being appropriate, and also the global audit system they have constructed, based on policies for determination of dismissal of or refusal to reelect accounting auditors and also evaluation and selection criteria for financial auditors.

| Name of auditing firm | Grant Thornton Taiyo LLC |

|---|---|

| Continuous audit period | 2 years |

| Certified Public Accountants who have executed operations for the Group |

Tatsuya Arai, Certified Public Accountant, Managing Partner, Designated Limited Liability Partner Takeshi Iwasaki Certified Public Accountant, Managing Partner, Designated Limited Liability Partner Daishi Nishimura Certified Public Accountant, Managing Partner, Designated Limited Liability Partner |

| Those with supporting roles for audit operations |

Certified public accountants: 17 Other supporters: 27 |

Internal audit status

The Internal Audit Division and internal audit departments at each Group company coordinate together to audit the appropriateness of our business operations and those of our subsidiaries, and to audit the preparation and operation status of internal control systems, including internal controls related to financial reporting. For the results of internal audits, we employ a dual reporting system in which the Internal Audit Division reports directly to our Board of Directors and Management Council, and on a quarterly basis to the Compliance Committee also attended by standing statutory auditors.

We also report internal audit plans, main internal audit results, and the status of improvement measures to our accounting auditor. We are also regularly reporting internal audit results and the status of improvement measures to statutory auditors, and we facilitate their mutual cooperation. In addition, we receive guidance and advice from legal experts.

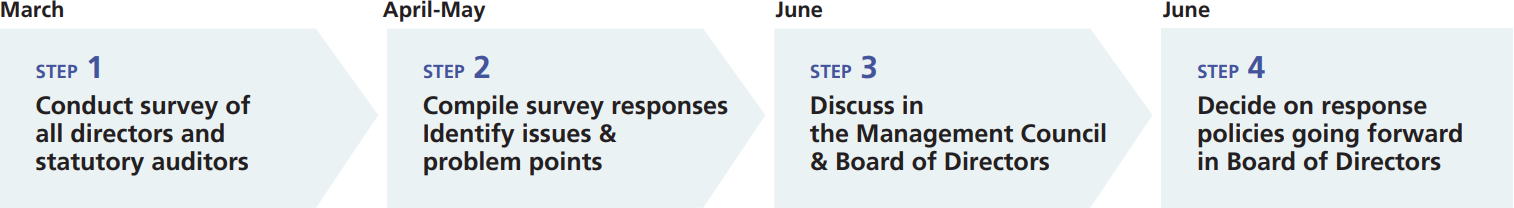

Evaluating the effectiveness of the Board of Directors

To enhance the function of the Board of Directors and business value, we evaluate the effectiveness of our Board of Directors based on the results of questionnaire surveys among all Directors and Statutory Auditors, which are collected and analyzed by an external organization to ensure objectivity. Based on the results of the analysis and discussion in the Board of Directors, it was confirmed that our Board of Directors has adequate scale and structure and is appropriately operated to ensure proper decision-making on important management agendas and supervision of business execution. As part of our efforts to strengthen our governance, we are working to increase our ratio of female officers. Since June 2023, we have one additional female independent outside director. Now with two female independent outside directors and two female independent outside statutory auditors for a total of four, women hold 24% of our officer roles.

In addition, we continued to distribute Board of Directors’ meeting materials as early as possible, to enhance the explanations that we provide in advance to independent outside directors and independent outside statutory auditors, and to arrange for site visits by independent outside directors. During fiscal 2023 under review we also conducted “Vector Meetings,” for 35 projects, in which all business units get on the same page by discussing their business strategies among other matters at an early stage. The Sustainability Committee also holds sufficient discussions on initiatives to improve sustainability such as ESG and the SDGs, and reports to the Board of Directors on a regular basis. Outside directors and outside statutory auditors actively make sound comments from an independent standpoint grounded in sufficient insight in discussions at meetings of the Board of Directors. We see the undeniable effects of these efforts in the strengthened effectiveness of the Board of Directors.

Going forward, based on these results of Board of Directors effectiveness evaluations and opinions, the Company’s Board of Directors will fully consider measures for improving its effectiveness and continue to implement initiatives for enhancing its functions.

Board of Directors evaluation process

Efforts in FY2024 to further improve effectiveness

| Topic | Description | Efforts in FY2024 |

|---|---|---|

| Operation of Board of Directors | Monitoring for the purpose of ongoing effectiveness improvements |

In addition to the above, also promote sustainability and report the status of our global business. |

| Secure time for strategic discussions |

|

|

| Board of Directors discussions | Make discussions more in-depth and effectiveness evaluations more strategic |

|

| Measures to enhance discussions and strengthen effectiveness evaluations |

|

* Worksite observations: Conducted four times in fiscal 2023. Outside directors and outside statutory auditors participate as much as possible at all observations. Observations are of all domestic and international plants of Group companies, etc.

Director appointment, composition, and development of successors

Desired qualities and appointment process

Our method for choosing candidates for directors is to hold deliberations in the Nomination Committee, an internal unit of the Board, on those with excellent character and insight, strong moral character, the energy to drive transformation, leadership skills, and the ability to make accurate decisions. The representative director then gives recommendations, suitability of the candidates is deliberated in the Board of Directors, after which offers are made and motions sent to the General Meeting of Shareholders. Appointments and dismissals of representative directors and executive directors are decided in the Board of Directors.

If there is a director who should be dismissed, the Board of Directors raises a motion for dismissal of the director in the General Meeting of Shareholders. To choose candidates for statutory auditors, the representative director recommends those with business management experience, expertise in finance and accounting, and the high-level insight needed to fulfill the role of a statutory auditor. Motions are then sent to the General Meeting of Shareholders after approval by the Board of Statutory Auditors.

Composition of the Board of Directors

We are committed to improving the activity level and governance of our Board of Directors by ensuring balance and diversity among their backgrounds areas of expertise.

Based on the belief that our number of directors can enable us to swiftly and accurately accommodate drastically changing business environments, we employ an operating officers system in order to further accelerate our decision-making.

Successor planning

We promote and attract management personnel from the outside in addition to internally. From among these personnel, our representative director identifies individuals who deeply understand our Group philosophy and management vision, have high ethical standards, leadership qualities, and the capability to drive the ongoing growth of the Group, and selects them as successors. Decisions on these successors are then made after deliberation in the Nomination Committee and Board of Directors.

Use of outside directors and auditors

The Company has five outside directors and three outside statutory auditors. The functions and roles that outside directors and outside statutory auditors should carry out in the corporate governance of the Company are as follows. Outside directors fulfill the function of supervising and monitoring the management of the Company from an independent and neutral standpoint, providing comments based on their abundant experience and wide-ranging knowledge. Outside statutory auditors fulfill the management monitoring function by auditing from an objective standpoint, offering a perspective informed by advanced expertise, abundant experience, and wide-ranging knowledge.

Regarding the criteria or policies concerning independence for appointing outside directors or outside statutory auditors, the Company secures independent directors and auditors in accordance with Article 436-2 and Article 445-4 of the Securities Listing Regulations of Tokyo Stock Exchange, Inc., and the criteria for determining independence stipulated by the same exchange (“Guidelines for Listing Management, etc.”).

Reasons for selection of outside directors

| Name | Job title | Year appointed | Reasons for selection |

|---|---|---|---|

| Yasushi Kohara | Director | 2018 | Having gained deep experience and insight in corporate management at the Toyota Group, Mr. Kohara has provided appropriate advice and recommendations in important management decisions of the Company, appropriately fulfilling his role as an outside director. |

| Naoko Iwasaki | Director | 2019 | Ms. Iwasaki is a leading international researcher and expert on digitalization in international relations, national and local government administration, disaster countermeasures and BCP, aging society, and women’s career advancement. She has provided appropriate advice and recommendations in important management decisions of the Company, appropriately fulfilling her role as an outside director. |

| Tatsushi Mochizuki | Director | 2020 | Mr. Mochizuki has been involved in key positions in central government ministries and local governments for many years. With the insight he has accumulated through his career, he has provided appropriate advice and recommendations in important management decisions of the Company, appropriately fulfilling his role as an outside director. |

| Keiji Yoshida | Director | 2021 | Mr. Yoshida has a wealth of experience and insight in corporate management as an officer of JFE Engineering Corporation and other companies. He has provided appropriate advice and recommendations in important management decisions of the Company, appropriately fulfilling his role as an outside director. |

| Tomoko Aramaki | Director | 2023 | Ms. Aramaki has a wealth of experience and expertise in finance and accounting as a CPA and tax accountant, in addition to being involved as a director and statutory auditor at other listed companies aside from ours and possessing insight in business management, with which she can be expected to contribute to strengthening the oversight function of the Board of Directors and provide appropriate advice and recommendations in important management decisions of the Company. |

| Shinnosuke Yamada | Statutory auditor | 2020 | Possessing a wealth of experience and expertise in finance and accounting as a CPA, Mr. Yamada has been auditing the business execution of directors from an independent standpoint while also appropriately fulfilling his role as an outside statutory auditor. |

| Kimiko Takahashi | Statutory auditor | 2021 | Possessing a wealth of experience and expertise in finance, accounting, and law as a CPA and attorney, Ms. Takahashi has been auditing the business execution of directors from an independent standpoint while also appropriately fulfilling her role as an outside statutory auditor. |

| Eiko Osawa | Statutory auditor | 2023 | Possessing a wealth of global experience and expertise in finance and accounting as a CPA at a major auditing firm, Ms. Osawa can be expected to properly execute her duties as a statutory auditor. |