Stock Quotes (TSE First Section:1951)

2025/06/20 15:30

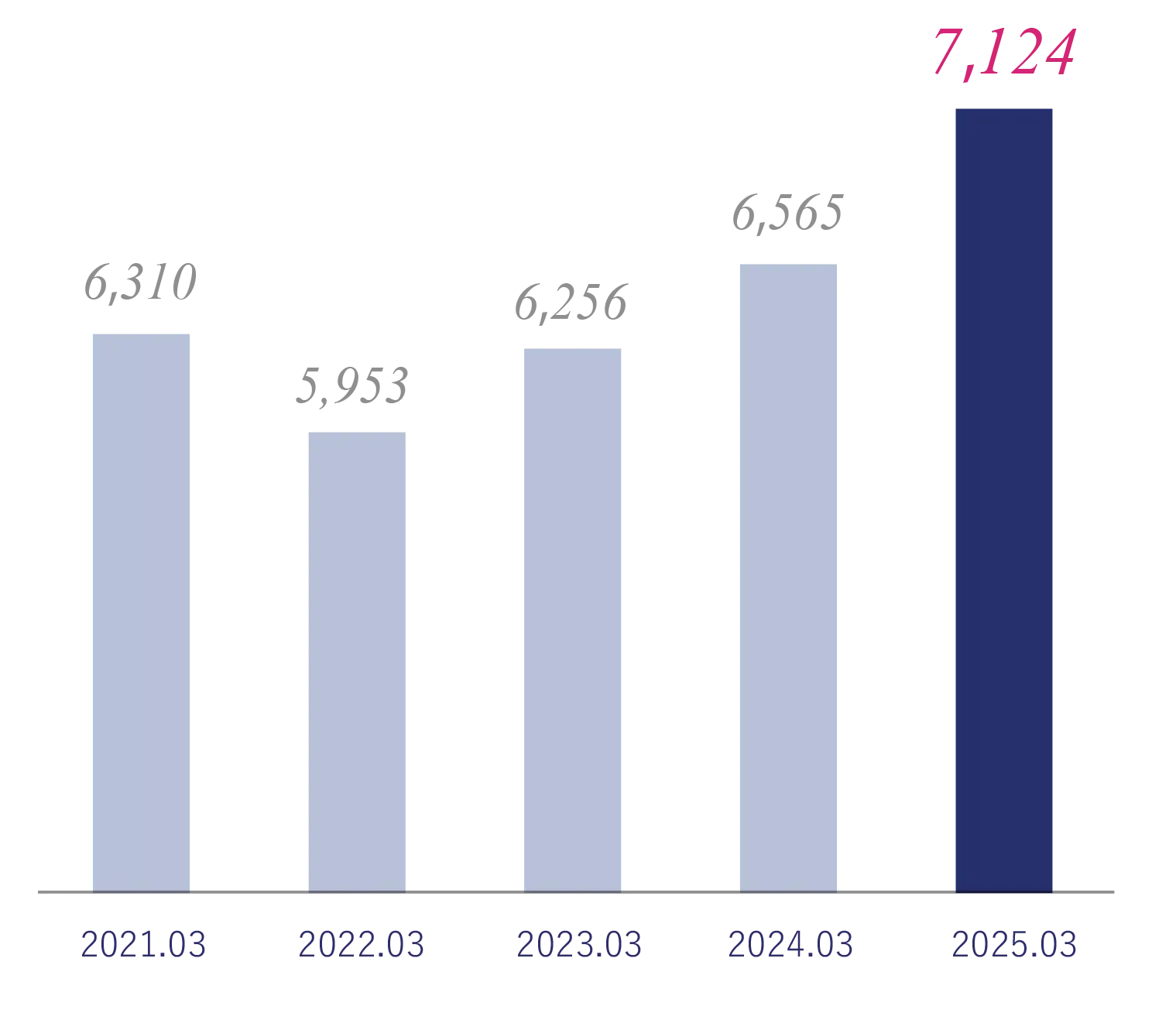

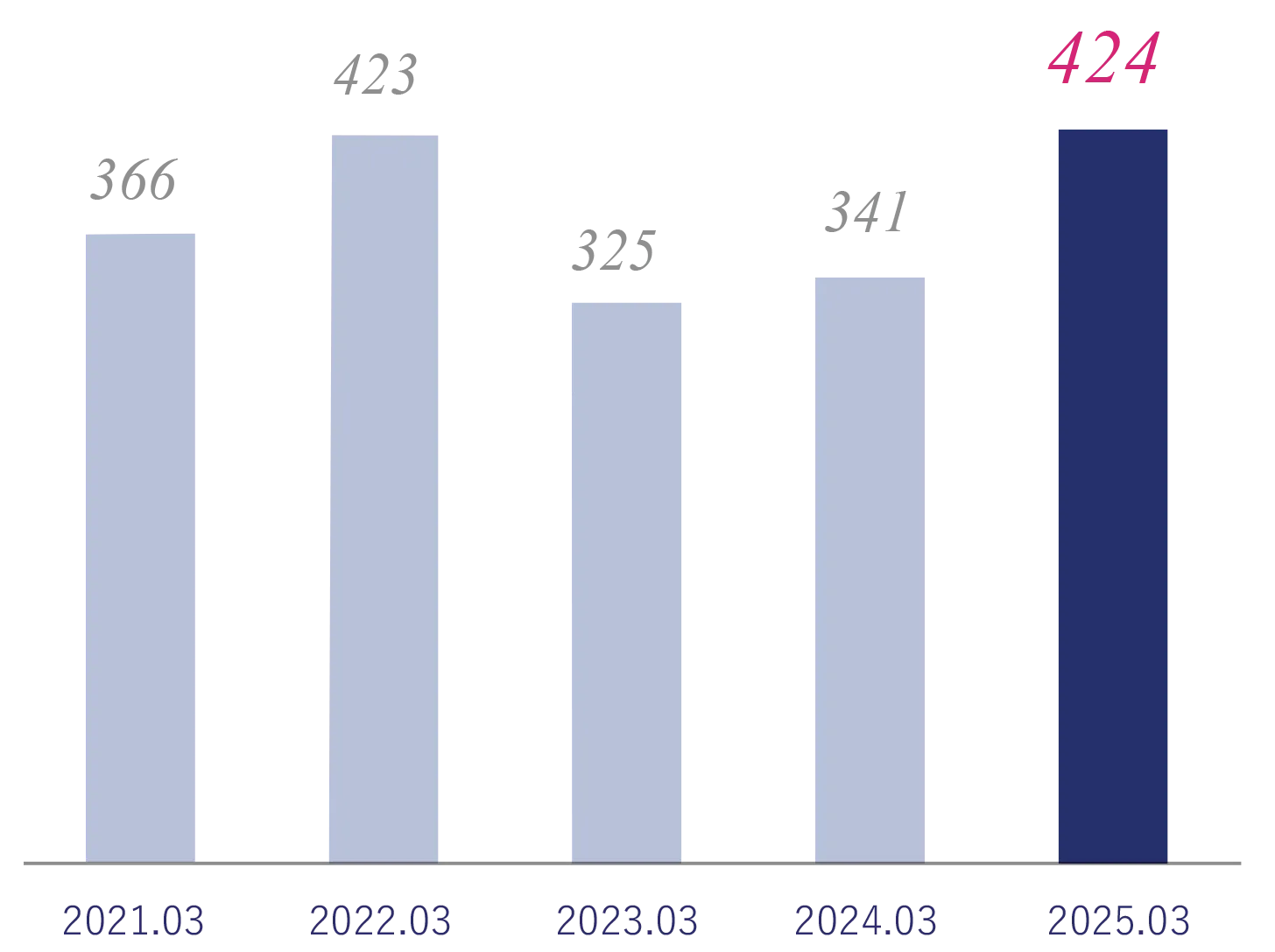

01 Orders received

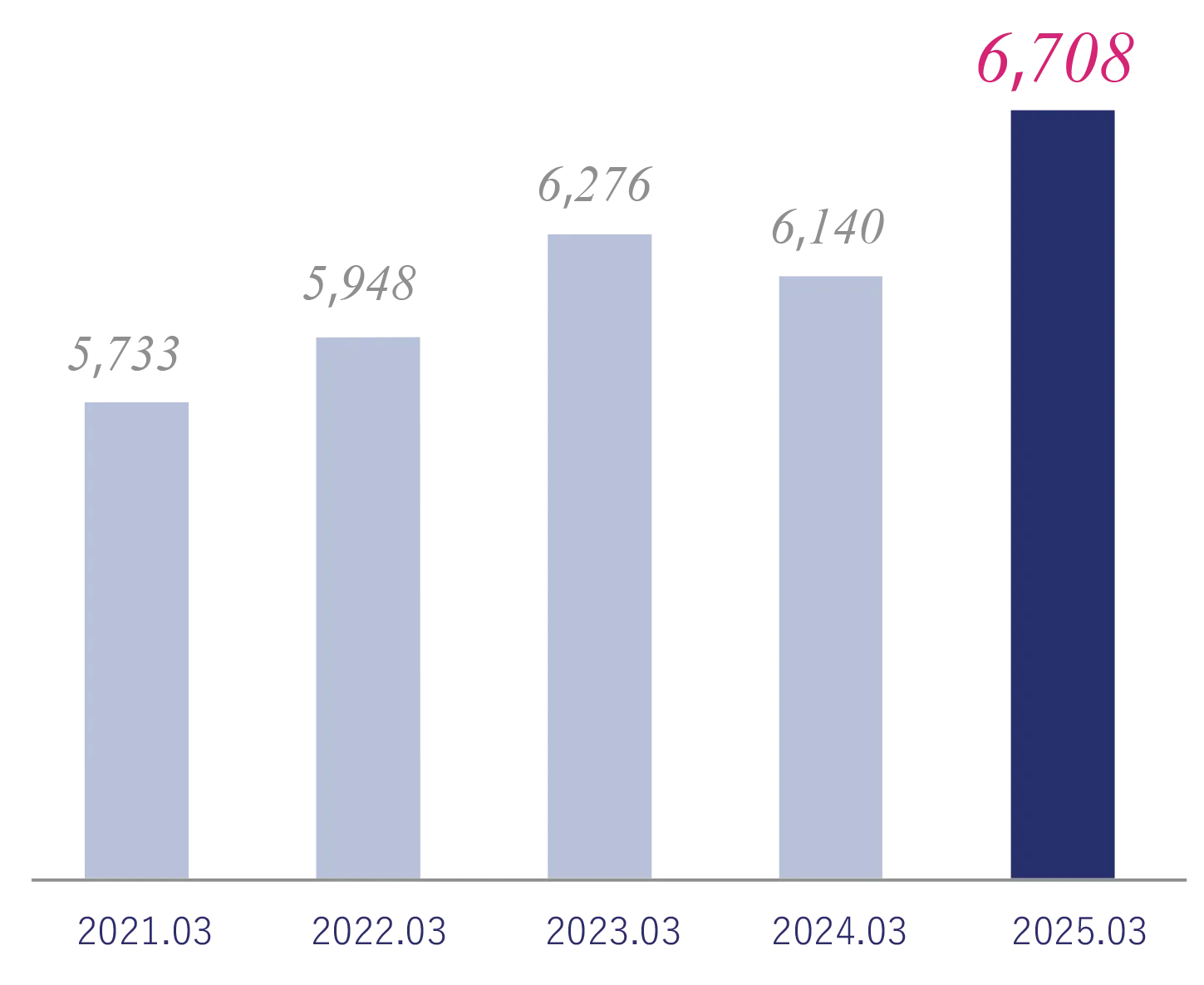

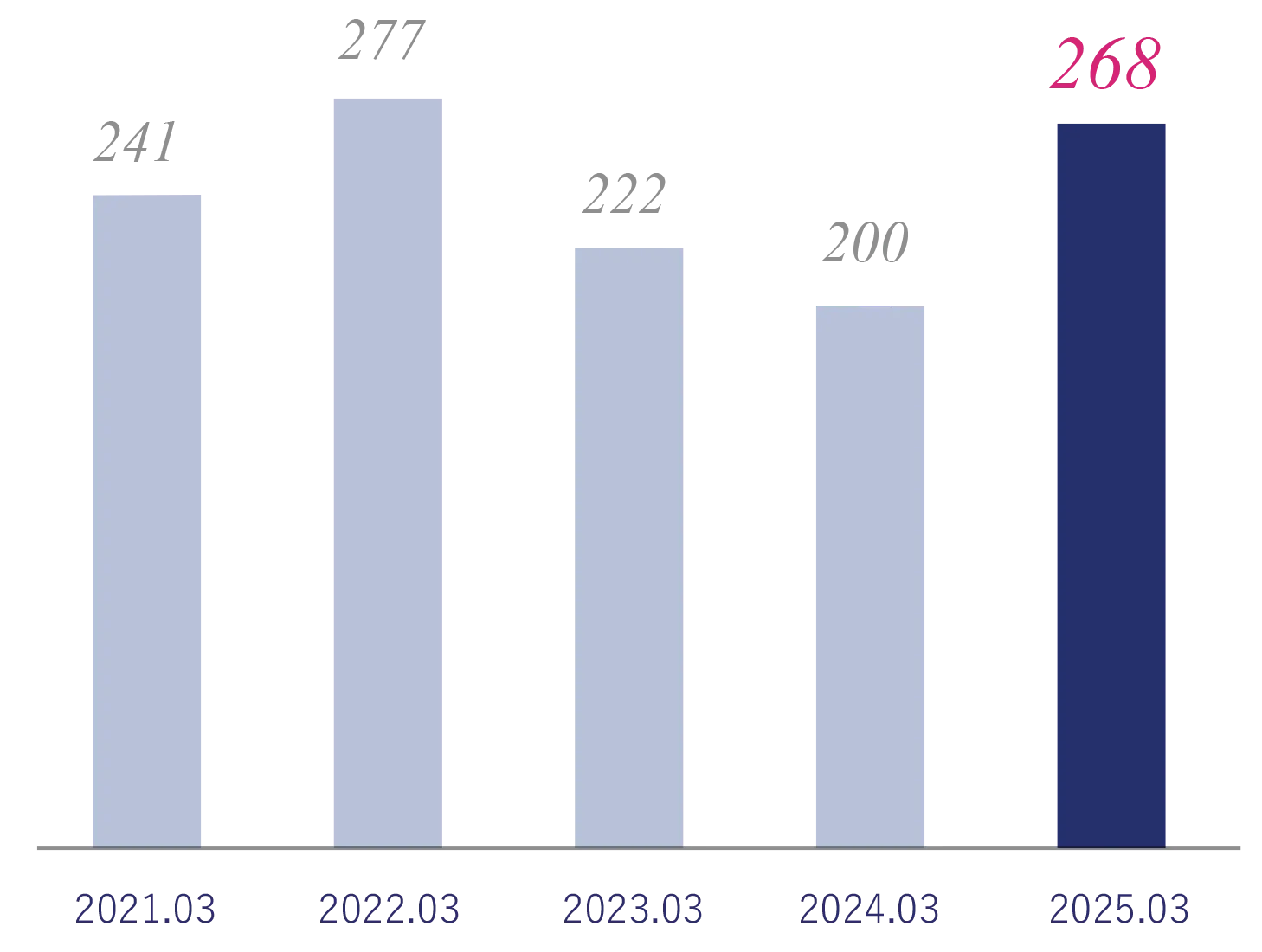

02 Net sales

03 Operating income

04 Net income attributable to owners of parent

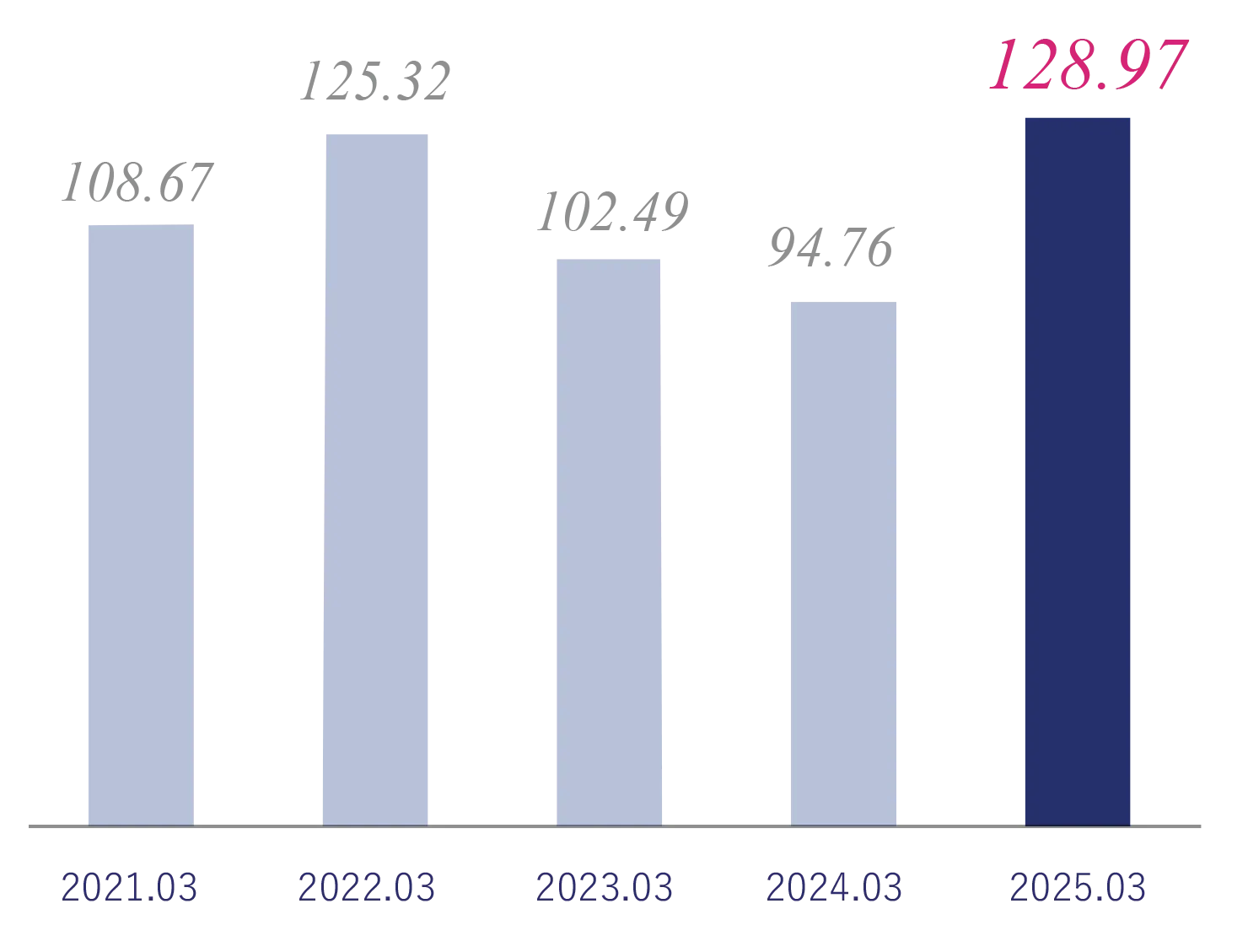

05 Earnings Per Share

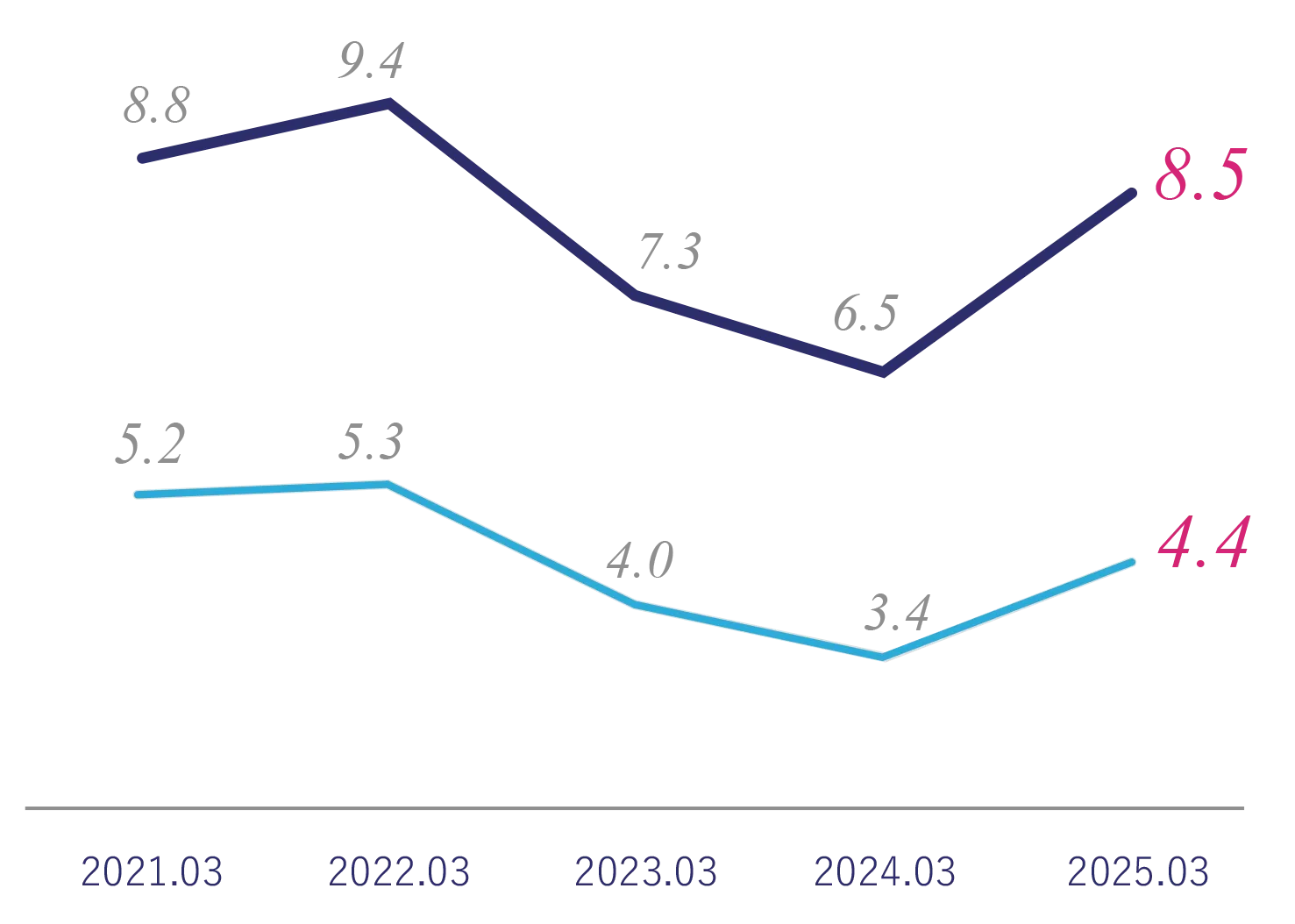

06 ROE/ROA

01 Consolidated Statements of Income

(¥billion)

| FY20 | FY21 | FY22 | FY23 | FY24 | ||

|---|---|---|---|---|---|---|

| Orders received | 631.0 | 595.3 | 625.6 | 656.5 | 712.4 | |

| Net sales | 573.3 | 594.8 | 627.6 | 614.0 | 670.8 | |

| Gross Profit | 75.8(13.2%) | 84.3(14.2%) | 81.8(13.0%) | 89.1(14.5%) | 100.4(15.0%) | |

| Selling, General and Administrative Expenses | 39.2(6.8%) | 41.9(7.1%) | 49.2(7.9%) | 55.0(9.0%) | 58.0(8.6%) | |

| Operating Income | 36.6(6.4%) | 42.3(7.1%) | 32.5(5.2%) | 34.1(5.6%) | 42.4(6.3%) | |

| Ordinary Income | 38.1(6.7%) | 45.2(7.6%) | 33.7(5.4%) | 36.9(6.0%) | 43.5(6.5%) | |

| Profit attributable to owners of parent | 24.1(4.2%) | 27.7(4.7%) | 22.2(3.5%) | 20.0(3.3%) | 26.8(4.0%) | |

02 Consolidated Balance Sheets

(¥billion)

| FY20 | FY21 | FY22 | FY23 | FY24 | ||

|---|---|---|---|---|---|---|

| Current assets | 300.2 | 326.6 | 353.7 | 347.8 | 387.7 | |

| Non-current assets | 191.3 | 208.9 | 224.2 | 243.7 | 254.7 | |

| Total assets | 491.5 | 535.6 | 577.9 | 591.6 | 642.5 | |

| Liabilities | Current liabilities | 156.2 | 157.7 | 159.0 | 177.7 | 206.6 |

| Non-current liabilities | 46.4 | 70.8 | 110.9 | 94.8 | 109.1 | |

| Total liabilities | 202.6 | 228.5 | 269.9 | 272.5 | 315.7 | |

| Shareholders’ equities | 285.6 | 303.3 | 303.1 | 313.0 | 321.0 | |

| Subscription rights to shares, Non-controlling interests | 3.2 | 3.6 | 4.7 | 5.9 | 5.7 | |

| Total assets | 491.5 | 535.6 | 577.9 | 591.6 | 642.5 | |

03 Consolidated statements of cash flows

(¥billion)

| FY20 | FY21 | FY22 | FY23 | FY24 | ||

|---|---|---|---|---|---|---|

| Net cash provided by (used in) operating activities | 6.3 | 26.4 | 5.4 | 41.9 | 6.8 | |

| Net cash provided by (used in) investing activities | -9.2 | -20.3 | -13.3 | -13.5 | -18.4 | |

| Net cash provided by (used in) financing activities | -1.7 | 5.0 | 3.2 | -30.5 | 2.8 | |

| Free cash flow | -2.9 | 6.0 | -7.8 | 28.3 | -11.5 | |

| Increase in cash and cash equivalents due to share exchange | 0 | 1.4 | 1.0 | -0.5 | 0.6 | |

| Cash and cash equivalents at end of period | 41.2 | 53.7 | 50.2 | 47.4 | 39.4 | |

Learn more